Pratim Ranjan Bose

The last fiscal was a milestone

year in the history of Indian power sector.

The generation capacity of the

world’s third largest electricity market grew by a record 9.6 per cent, much

ahead of China ’s 4 per cent

and 0.7 per cent of the US .

The growth was driven by the

mammoth thermal power capacity addition programme, initiated by the former UPA

government (and is continued by the current Narendra Modi government in Delhi),

that ended up pushing the share of coal based electricity to 74 per cent in

2014, higher than China’s 72 per cent (down from 79 per cent in 2011).

But, the achievement will look

pale if compared against the generation records.

In the peak summer months of

April-June 2015 coal-fired electricity generation has gone up by a mere two per

cent that too riding on distress sale by private producers (IPP), accounting for one-third of India’s coal-based electricity

capacity of 160671 MW.

Distress sale of

electricity

The reasons behind the distress sale of electricity are simple, as

against a projected 80 per cent (or more) capacity utilisation to break-even; IPPs

record a mere 55 per cent plant-load factor (PLF). In other words, half of the

53,834 MW private capacities are stranded and are hard pressed to meet payment

obligations to lenders. And, in a short-sighted or suicidal move, they decided

to sell power merely at recovery of fuel cost.

The desperation on the part of

private producers had cast a shadow on the capacity utilisation of the Government

run utilities, the mainstay of Indian power sector. With electricity available

in the open market at as low as Rs 2 a unit, there was a drop in demand for power

generated by the government sector that was otherwise considered cheap.

Records available with India ’s

electricity regulator suggest both the Central and the State Government run

utilities recorded a marked drop in generation, during the summer months. This

is unheard of in the history of India ’s

electricity business.

The country’s largest electricity

producer, the Central Government owned NTPC (45,500 MW) - that was known for

high capacity utilisation - recorded a steep fall in PLF from 78 per cent to 73

per cent over the same period last year. Capacity utilisation of State Government run utilities (58340 MW), is down from 62 per cent to 56 per cent.

Coal stock overflowing

To cut the long story short, India ’s

electricity generation business is facing an unprecedented crisis. The rush for

capacity addition, without creating ground for higher demand, ended up blocking

huge capital in unproductive generation assets. The trend was setting in for

last two years. The Indian government and the industry in their good wisdom was blaming it on non-availability of fuel, but no more.

Generation utilities were flushed

with coal (with three weeks average stock) throughout the summer months, so

much so that they are now refusing to take more deliveries. The Government-owned Coal India (CIL) sold less fuel to power sector in July-August, when

compared to the same period last year, resulting into sharp rise in pit-head

stock - once again blocking precious capital.

A rough assessment says one-third

of the additional CIL production in April-June quarter and two-third of the added

capacity in July-August didn’t find takers. For the first time in decades, the

coal major saw accrual of inventory in first half of the fiscal. Normally

inventories are depleted in the first half when 40 per cent of the annual

output is produced and demand for fuel remains high.

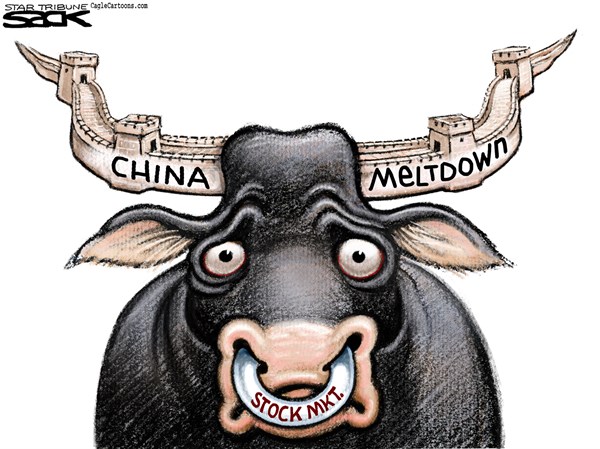

Following Chinese example?

There are many reasons behind the

crisis in India ’s

power sector and, one can safely assume this storm will not pass overnight. But

before we delve into that, a look at global affairs will tell you that stranded

power station is no isolated phenomenon.

In the deregulated developed

economies, especially in the US

– the country that records the highest in per capita energy consumption –

plant-load factor remains low. That is legacy of an economic model built on

opulence. It has little relevance to a developing country, which is aiming to

build an industrial empire riding on cost arbitrage. The Indian case is rather

comparable to the Asian superstar China ,

which is equally sensitive to electricity tariff and (like India ) the

power sector is largely regulated.

Having expanded its generation

capacities in leaps and bounds over the last two decades, Chinese electricity

companies have been in trouble for last five odd years. In 2011, China ’s

five largest power companies – Huaneng, Datang, Huadian, Guodian and China

Power Investment (CPI) - suffered an aggregate loss of more than $2.4 billion. This

was primarily due to low tariff realisation vis-à-vis high cost of fuel owing

to deregulation of coal prices. According to The Time Weekly, 17 out of 24

electricity firms listed on Shanghai

and Shenzhen stock exchanges were stressed in 2012.

While the global commodity market

meltdown finally resolved the issue of volatility in fuel prices; the unabated

expansion of coal fired generation capacity vis-à-vis slow down in economic

growth, coupled with marked decline in renewable energy tariff and a public

outrage against pollution put Chinese electricity sector face-to-face with a

colossal waste.

As a recent report in Business

Spectator puts it, “The old factoid about China

adding one coal plant per week, deserves to be updated — China is now adding one IDLE coal power plant per week.”

More capacity, more trouble

Chinese electricity generation sector

is four-and-a-half times bigger than India . Naturally it would have a

much bigger fleet of idle capacities. But Indian problem is not insignificant

either.

All of the 19,000 MW coal fired

station added since June last year are idling for lack of buying activity.

Overall some 20,000-25,000 MW private utilities and another 10,000-15,000 MW

State sector capacities are stranded. With another 15,000-17,000 MW thermal

capacities in advanced stage of commissioning, the list of idle capacities may only be longer by the end of this

fiscal.

The supply pressure will further

intensify if the Modi government is successful in doubling the generation capacities (that includes a mammoth 75,000 MW renewable capacity addition

target) in next five years. Considering the steady decline in generation cost of renewable energy, the

outlook is particularly grim for thermal sector; unless there is a dramatic surge

in demand.

The India government is banking on its ‘Make-in-India’

campaign and rural electrification drive to strengthen demand for electricity.

Theoretically, they are not wrong. High government spending in social security, over

the last decade, has created a huge latent demand for electricity in the rural India that

is remaining untapped due to low proliferation of transmission and distribution

network.

Almost an entire Bihar (100

million population) and half of UP (200 million population) are not connected

by electricity grid, thereby pulling down the national per-capita consumption

to a minuscule 760 kilowatt hour (Kwh), which is a fraction of Chinese average (3475

Kwh).

The UPA government wanted to

address this issue as a precursor to capacity boost but ended up with limited success.

The Modi government too targets 100 per cent rural electrification. Probably, they will go another few steps ahead with the agenda. But I

doubt if they will reach anywhere near the target in the stipulated five years.

The reason lies in the complexity

of India ’s

electricity administration that is a joint responsibility of the Centre and the

States. As per the federal structure, electricity distribution is an exclusive

domain of the State governments. And, despite at least two rounds of financial

restructuring initiatives taken by the Delhi, a majority of the State distribution

utilities (discoms) are cash-starved due to prolonged abuse by the politics. To know the extent of the malady you may read my article here.

The Centre is now trying to enforce fiscal discipline in discoms by a fresh

amendment in Electricity Act, but that is yet to be cleared by the Parliament.

Industrial growth holds key

But a bigger issue, probably the

biggest of all, is yet to be resolved: Can India pull up its growth numbers?

The recent slowdown in

electricity demand is directly linked to the country’s dwindling industrial growth figures. The last fiscal was one of the worst in the history of corporate India

and the latest cut in growth forecasts by Moody’s indicate that the trouble is

not over yet.

The Modi government has surely

attracted global attention in its effort to push India as a manufacturing

destination, as is reflected in the rush of investment proposals. But the moot question remains: How much of it will bear fruit and how soon? Considering

the huge build up of idle capacities; the longer the gestation, more prolonged will

be the pain for India ’s

financial sector that is burdened with a stockpile of sticky assets.

A recent report by the Cleveland

based Institute of Energy Economics and Financial Analysis (IEEFA) says a lower than projected growth may leave the economy with “$100 billion of

stranded thermal power plants running at low utilisation rates and delivering

continued net losses for shareholders and banks”.

***

Tweet: @pratimbose

(Disclaimer: Graphics are collected from the web. Will be removed in case of any objection.)