Pratim Ranjan Bose

While liberalising India in 1991,

P V Narasimha Rao predicted the end of the road for political and economic

monopolies, ensuring growth.

Part of his expectations came

true.

Congress, which nearly

monopolised power till 1980’s, turned anaemic. The benefit mostly went to

regional parties. The GDP of India grew more than five times in 25 years. Hyderabad became an IT

city and Chennai is now auto-hub.

But, Rao didn’t anticipate the

rise of ‘politics of cartelization’ that dominated India in the last decade.

National and strategic interests,

including a defence deal with Sri

Lanka , became hostage to micro-interests.

Parallel power centres bred reckless corruption. And growth became a casualty.

Rise of corrupt India

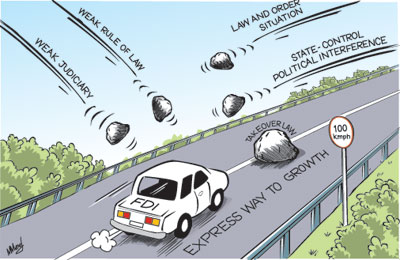

Many investors are now avoiding

Chennai because politics has become too greedy and every successive party in

power is asking for a higher cut– anything in excess of 10 percent of project

cost.

The typical fallout is a dramatic

rise of the cash-economy. According to the largest banker, SBI, its daily cash

dispensation increased manifold over the last decade.

A parallel rise in the share of

high denomination notes of Rs 500 and Rs 1000 from 46 to 86 percent of total

currency circulation, between 2006 and 2016, indicate part of this cash was

stored.

The increasing cash intensity was

disproportionate to India ’s

stagnant tax-GSDP ratio of nearly 17 per ent – lowest among BRICS – and low

Income Tax base. According to NITI Ayog, only one per cent Indians out of 1.2 billion pays taxes.

Compare this with the dramatic

rise in unofficial election expenses in India and you know, politics encouraged

tax evasion and black money generation for own benefit.

Reimaging India

The prevailing paradigm had

raised some serious doubts about the efficacy of democracy in delivering public

policy goals and ensuring better life to its people vis-à-vis the single

party-ruled China that has

50 percent more forex reserve than India ’s GDP.

In China in 2010, when they were still

discussing political reforms, as was promised by Deng Xiao Ping, I noticed

strong resentment of the Chinese against the Indian democracy. They felt it’s a

chaotic system that they could do without.

Narendra Modi of BJP came to

power in 2014 with a landslide victory – the first of its kind since 1984 –

promising a change of this political narrative.

Over the last two years, the

government gave options to bring money stashed in abroad and disclose

unaccounted earnings. Treaties were entered with tax-heavens like Cyprus and Mauritius . Switzerland

agreed to exchange account information on Indians from 2018.

Some responded to these warning

signals but most didn’t. Despite encouragements, cashless transactions

staggered at around 10 per cent in volume terms. According to SBI, daily cash

dispensation increased by 60 per cent over last three years.

Clearly, the cash economy thought

it is too big to be messed with. Modi decided to do the unthinkable. He bombed

them to redefine the image of India

and Indian democracy that was considered toothless.

On November 8, the nation was

awestruck to hear the Prime Minister announcing a midnight ban on high

denomination notes, constituting 86 percent of the currency in circulation to

flush out idle, unaccounted cash or black money.

The demonetised currency of Rs

500 and 1000 are replaced by the new currency of Rs 500 and 2000. The partial

demonetisation scheme is scheduled to be over on December 30.

Huge step

Politically, the ferocity of the

decision is comparable to the nationalisation of coal, banking and insurance

sectors, between end 1960’s and early 1970’s taken by Indira Gandhi.

Some were unhappy that government

is infringing on their ‘democratic right’ by setting (temporary) withdrawal

limits to ration the new currency and, literally forcing them to take cashless

transaction modes like plastic or digital money.

The politics of cartelization

that was put on the back foot over the last two years, saw a danger. Leftist

dominating the intellectual space breathed fire. Nobel laureate Indian

economist,

Amartya Sen –a known political

adversary of Modi - referred the decision as ‘despotic’. One might wonder how

Sen would react to Chinese President Xi Jinping’s decision to close down 100

million tonne steel and nearly 500 million coal production - robbing millions

of jobs – to correct market anomalies.

Forbes had taken a high moral

position. In China Xi had put them on double muzzle, as part of his political

consolidation and crackdown against corruption since end 2012. They will sing

in tune if Modi can make India

stronger.

‘Unusual decision’

American economist Paul Krugman

described Modi’s decision “unusual” as it didn’t follow the textbook principles

of replacing high-value currency by low lower denomination notes. This made

Krugman sceptic about the gains. He, however, didn’t trash the initiative.

As a journalist who had been

tracking the issue closely, I don’t have much explanation for issuing the Rs

2000 bill either. But I have a hunch that it’s bait for further action. Only

time will tell if I am correct.

Meanwhile ‘demonetisation Guru’,

Kenneth S. Rogoff of Harvard is watchful.

“Over the long run, there will be

a lot of studies: Is it a success? Is it something people are going to

remember? Does it inspire other laws and other changes that energise people

against corruption?” a The New Yorker columnist quoted him saying.

He has little doubt that higher

degree of corruption is behind India ’s

poor show vis-à-vis China .

“If you want to know why India

has not grown as much as China ,

as bad as the corruption is in China ,

it’s worse in India .”

He also has two specific

observations to make on the move. (a) Modi is “aiming, really, at the

psychology”. And (b) this disruption should reduce India ’s appetite for cash in the

future. “When you take bills out of circulation at short notice, that’s going

to cut cash demand in the future,” he said.

And, I think he is correct on

both.

While detailed information is not

yet available. A snapshot of transactions through major banks in the East, the

most cash-intensive part of the country, says non-cash transactions increased

from 10 per cent to 25 per cent of total.

Even the predominantly cash-based

agri-input trade is now turning cashless which means the planners will have a much realistic data sheet on money trail

and purchasing power of the rural economy in the future.

If I am not wrong, the rise in

cashless transactions will give the central bank room to cut total currency

requirement. This means the government will have more headroom to fund mega

infrastructure projects. We are likely to get a direction on the same in the

annual Budget.

As demonetisation has brought

idle money into the system, banks will be under pressure to increase credit

flow. This, in turn, means interest rates should fall, if not today them

tomorrow surely.

The other big impact is, once the

share of black in the economy is down, there will be less incentive to pay in

black. It means maladies of the real-estate sector will be addressed to a large

extent.

If the current trend is of any

significance, pressure will intensify on the corrupt, in the days to come. The exemplary raid onTamil Nadu Chief secretary’s office and residence is a case in point.

The recovery of Rs 135 crore in

cash and 177 kg of gold from a sand mafia also from Chennai, on the same day,

should make many sweating in their pants.

More changes coming

A day after announcing

demonetisation, Modi went a step ahead to declare his next big war against the

unaccounted holding of gold and property through frontmen. His government has already

strengthened Benami Transactions Act in October.

On Sunday, December 26, barely

four days ahead of the December 30 closure of the demonetisation scheme, Modi

reiterated that this is just the beginning of the firework.

“I am not going to stop at this.

I will expose the history of corruption of 70 years since Independence ,” he said

There is reason one should

believe this is no empty threat. First, having taken the ‘unusual step’, Modi

created a huge psychological impact. It would be foolish for the government to

lose the advantage. And, he is no fool.

Second, in cricket – the most

popular game in India

– once the batsman steps out of the crease, he has to either hit the ball or

else be stumped. Modi has to win this game.

It doesn’t mean the contest will

be one sided. The experience of last 45 days shows that the government failed

to judge the tremendous resilience of cash hoarders in finding newer ways to

launder money.

Large hoarders hired services ofthe poor, for a cut, to split the booty and avoid tax glare.

This is why more than $10 billion were deposited in zero-balance financial inclusion accounts. Some were fool

enough to deposit in crores even and will now face tax authorities.

Finally, it brought out the

weaknesses of Indian banking system to the open. In August 2014, the Prime

Minister launched a financial inclusion programme. The scheme was enticed by

low-cost life insurance coverage.

But banks clearly took it easy.

At least 60 percent of 1.7 million tea workers in Bengal and Assam and a

substantial chunk of 400 thousand jute workers didn’t have accounts when

demonetisation was announced.

Demonetisation also exposed

corruption in banking circle. Many bank officials diverted new currency to hoarders through the backdoor, while legitimate

customers kept waiting at the counter.

Nearly a dozen such cases are

unearthed by investigating agencies over the last few weeks. And many bank

officials were sacked.

Economy is not bombed

Many pundits believe in his

effort to bomb the corrupt, Modi actually bombed the economy. I don’t believe

this.

First and foremost, the rural

economy that pulls consumption is largely unaffected. I have personally

travelled in the hinterlands and monitored reports from Eastern

India and, I didn’t find many traces of impact on agriculture and small trade.

It doesn’t mean disruption didn’t

affect them. It only means they absorbed the shock, too soon.

The funniest part is responding

to the media speculation on agriculture, the government immediately relaxed

import norms for wheat. Now the same media is criticising the decision as there

is a bumper wheat crop this year.

The crackdown will surely impact

the sections of the informal economy that were avoiding a cleaner business

model by choice. Sand and stone miners, wholesalers, SMEs, jewellers, labour

contractors, textiles industry, truck operators - fall in this category.

They are no small fellows. They

became rich by dodging tax and/or flouting laws. Garments industry in Jalandhar

and Ludhiana

thrived by paying workers less. Years of fine policy making couldn’t deter

them, due to political patronage.

That jute and plantation industry

were dealing in cash for so long is a glaring example. Crude force saw them giving

way to the much-awaited change There are more fundamental

reasons why I think the economy will recover from the temporary shock, sooner

than perceived.

Modi inherited an economy in

tatters in 2014. Excessive greed created huge idle capacities in the power

sector; road and highway construction was stalled impacting job creation and

blocking huge bank finance that in turn was creating liquidity-crisis.

The gas sector was in disarray in

every front. Fertiliser was in short supply.

Series of scams dislodged private

mining activity. Courts were running shadow government with policy U-turns

becoming a norm. The government had low credibility. And, no investor was ready

to invest. Most were out of money. The world community was losing interest in India .

The government couldn’t address

every problem. Private investment in manufacturing, for example, is still

low. But the achievement is not insignificant

either.

The buoyancy in PSU coal mining

activities covered slow movement in captive coal and iron ore mining, solved

energy crisis, brought idle power capacities back into the fray, lowered coal

import requirement to nearly half thereby releasing pressure on current account

and, even triggered growth in mining equipment sales.

Merger and acquisition are back

in power, unlocking resources in banking. There is no fertiliser crisis

anymore. Steel prices are showing signs of firming up. And, highway

construction is back in full swing.

After five long years of

de-growth, construction equipment market is witnessing 40 per cent growth in

sales. It means two things a) job creation is back and b) overall growth will

be back soon due to the common multiplier effect.

Here are three examples to prove

my point a) Robust growth continues in Infrastructure equipment finance b) Bloomberg quit reports after 20 per cent fall in November car sales up by

seven per cent in December.

c) Micro-finance institutions

report normal recovery, except in three big States where Opposition is pushing

for a farmers’ loan waiver. MFIs operate in the rural and get payments in cash.

Will Modi win this game?

This is a big question that will

be answered amply in the four-corner UP polls where caste and creed rule the

roost. BJP in my assessment was the second most popular party here until

November. If they do any better it will be for public support to

demonetisation.

The party meanwhile won the civic polls in Chandigarh

and attributed it to demonetisation

My personal reading based on the

travels to the hinterlands of Eastern part India - that is most averse to

change and is the biggest victims of the corrupt politics of cartelization – is

Modi’s fight against corruption won the hearts of majority voters irrespective

of class and creed. The support is most overwhelming among the poor.

But even if he doesn’t win,

politics will surely change hereafter as Modi’s actions affected illicit

resource flow to every party including BJP. They have to brace for change.